Economy and business

Economics

What Is Economics, and Why Is It Important?

Economics seeks to solve the problem of scarcity, which is when human wants for goods and services exceed the available supply. A modern economy displays a division of labor, in which people earn income by specializing in what they produce and then use that income to purchase the products they need or want. The division of labor allows individuals and firms to specialize and to produce more for several reasons: a) It allows the agents to focus on areas of advantage due to natural factors and skill levels; b) It encourages the agents to learn and invent; c) It allows agents to take advantage of economies of scale. Division and specialization of labor only work when individuals can purchase what they do not produce in markets. Learning about economics helps you understand the major problems facing the world today, prepares you to be a good citizen, and helps you become a well-rounded thinker.

Microeconomics and Macroeconomics

Microeconomics and macroeconomics are two different perspectives on the economy. The microeconomic perspective focuses on parts of the economy: individuals, firms, and industries. The macroeconomic perspective looks at the economy as a whole, focusing on goals like growth in the standard of living, unemployment, and inflation. Macroeconomics has two types of policies for pursuing these goals: monetary policy and fiscal policy.

How Economists Use Theories and Models to Understand Economic Issues

Economists analyze problems differently than do other disciplinary experts. The main tools economists use are economic theories or models. A theory is not an illustration of the answer to a problem. Rather, a theory is a tool for determining the answer.

How To Organize Economies: An Overview of Economic Systems

We can organize societies as traditional, command, or market-oriented economies. Most societies are a mix. The last few decades have seen globalization evolve as a result of growth in commercial and financial networks that cross national borders, making businesses and workers from different economies increasingly interdependent.

A stock exchange is an organized market where tradable securities, commodities, foreign exchange, and options contracts are bought and sold. Exchanges bring together brokers and dealers who buy and sell these objects.

Stock exchanges can be subdivided by the type of trade into classical exchange and futures exchange. Classical exchange refers to a spot market, which is a public financial market in which subjects are traded immediately. Futures exchange refers to a market in which delivery is due at a later date.

To be able to trade a security on a certain stock exchange, the security must be listed there. Usually, there is a central location of exchange at least for record keeping, but trade is increasingly less linked to a physical place, as modern markets use electronic communication network.

The idea of exchange and borrowing dates back to the ancient world, based on Mesopotamian clay tablets with interest-bearing loans. The stock market existed even back in ancient Rome. The first actual brokers appeared in the twelfth century when foreign exchange dealers in France had the responsibility for controlling and regulating the debts of agricultural communities on behalf of banks. The first documented crash of the stock exchange took place in 1636 in Holland. The prices of tulip bulbs reached very high levels. This was known as the Tulip mania. The price collapsed on October 1. The first to use the stock market to finance companies were the Dutch, in the seventeenth century. In the nineteenth century, the industrial revolution enabled rapid development of stock markets. The development of information technology led to a new type of electronic exchange.

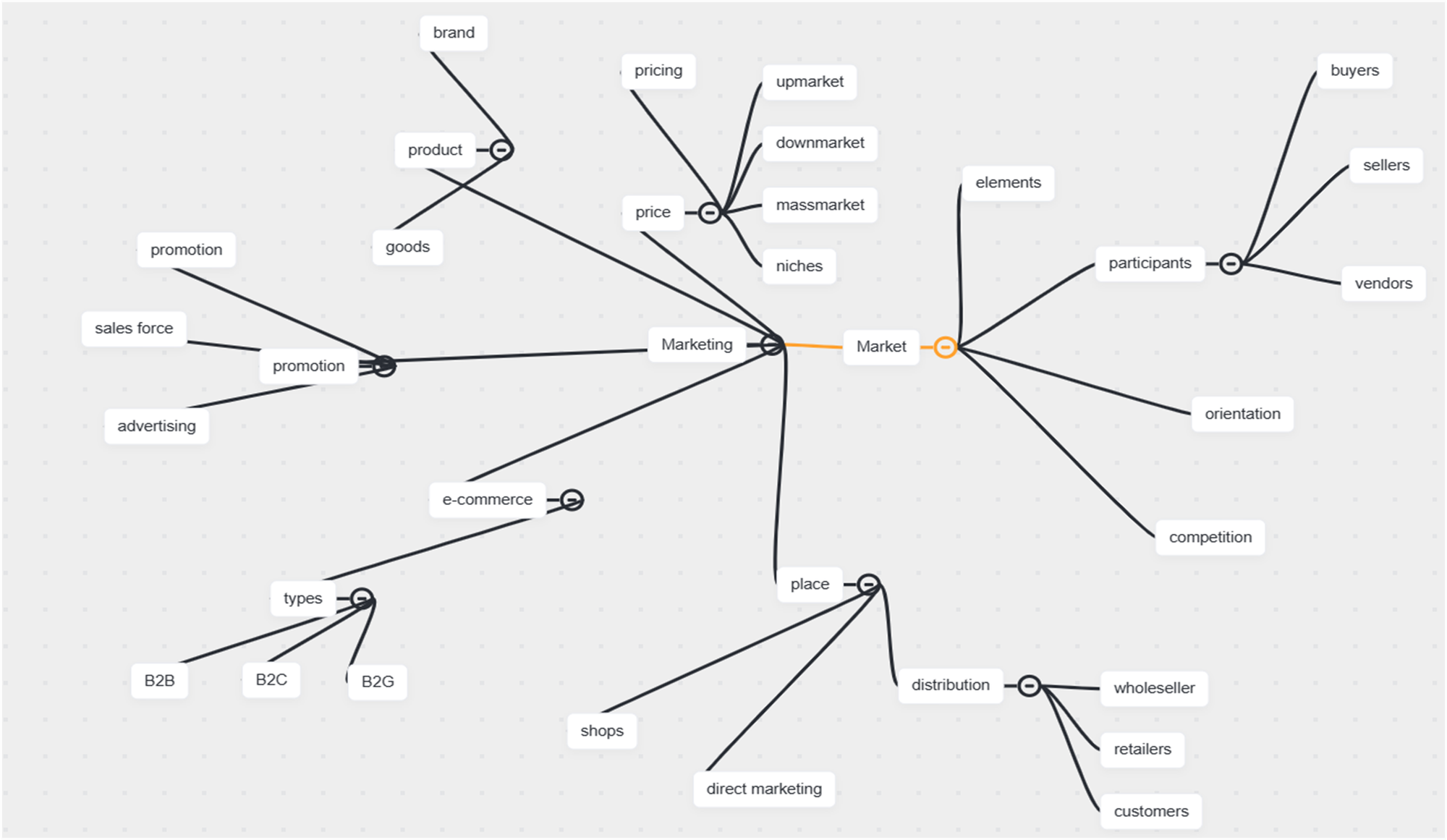

Marketing

Microeconomy

1 Fundamentals of Economic Analysis

1.1 Scarce Resources

1.2 Production Possibilities

1.3 Functions of Economic Systems

Economics: The study of how people, firms, and societies use their scarce productive resources to best satisfy their unlimited material wants.

Resources: Called factors of production, these are commonly grouped into the four categories of labor, physical capital, land or natural resources, and entrepreneurial ability.

Scarcity: The imbalance between limited productive resources and unlimited human wants. Because economic resources are scarce, the goods and services a society can produce are also scarce.

Trade-offs: Scarce resources imply that individuals, firms, and governments are constantly faced with difficult choices that involve benefits and costs.

Opportunity cost: The value of the sacrifice made to pursue a course of action.

Marginal: The next unit or increment of an action.

Marginal benefit: The additional benefit received from the consumption of the next unit of a good or service.

Marginal cost :The additional cost incurred from the consumption of the next unit of a good or service.

Marginal analysis: Making decisions based upon weighing the marginal benefits and costs of that action. The rational decision maker chooses an action if the MB ≥ MC.

Production possibilities: Different quantities of goods that an economy can produce with a given amount of scarce resources. Graphically, the trade-off between the production of two goods is portrayed as a production possibility curve or frontier.

Production possibility frontier: A graphical illustration that shows the maximum quantity of one good that can be produced, given the quantity of the other good being produced.

Law of increasing costs: The more of a good that is produced, the greater the opportunity cost of producing the next unit of that good.

Absolute advantage: This exists if a producer can produce more of a good than all other producers.

Comparative advantage: A producer has comparative advantage if he can produce a good at lower opportunity cost than all other producers.

Specialization: When firms focus their resources on production of goods for which they have comparative advantage, they are said to be specializing.

Productive efficiency: Production of maximum output for a given level of technology and resources. All points on the PPF are productively efficient.

Allocative efficiency: Production of the combination of goods and services that provides the most net benefit to society. The optimal quantity of a good is achieved when the MB = MC of the next unit. This only occurs at one point on the PPF.

Economic growth: This occurs when an economy’s production possibilities increase. It can be a result of more resources, better resources, or improvements in technology.

Market economy (capitalism): An economic system based upon the fundamentals of private property, freedom, self-interest, and prices.

2 Demand, Supply, Market Equilibrium, and Welfare Analysis

2.1 Demand

2.2 Supply

2.3 Market Equilibrium

2.4 Welfare Analysis

3 Elasticity, Microeconomic Policy, and Consumer Theory

3.1 Elasticity

3.2 Microeconomic Policy and Applications of Elasticity

3.3 Trade Barriers

3.4 Consumer Choice

4 The Firm, Profit, and the Costs of Production

4.1 Firms, Opportunity Costs, and Profits

4.2 Production and Cost

5 Market Structures, Perfect Competition, Monopoly, and Things Between

5.1 Perfect Competition

5.2 Monopoly

5.3 Monopolistic Competition

5.4 Oligopoly

6 Factor Markets

6.1 Factor Demand

6.2 Least-Cost Hiring of Multiple Inputs

6.3 Factor Supply and Market Equilibrium

6.4 Imperfect Competition in Product and Factor Markets

7 Public Goods, Externalities, and the Role of Government

7.1 Public Goods and Spillover Benefits

7.2 Pollution and Spillover Costs

7.3 Income Distribution and Tax Structures

Skills: (you will be able to):

• Discuss the importance of studying economics

• Explain the relationship between production and division of labor

• Evaluate the significance of scarcity

• Describe microeconomics

• Describe macroeconomics

• Contrast monetary policy and fiscal policy

• Interpret a circular flow diagram

• Explain the importance of economic theories and models

• Describe goods and services markets and labor markets

• Contrast traditional economies, command economies, and market economies

• Explain gross domestic product (GDP)

• Assess the importance and effects of globalization